Navigating Banking to Emerge Stronger Digitally

Navigating Banking to Emerge Stronger Digitally

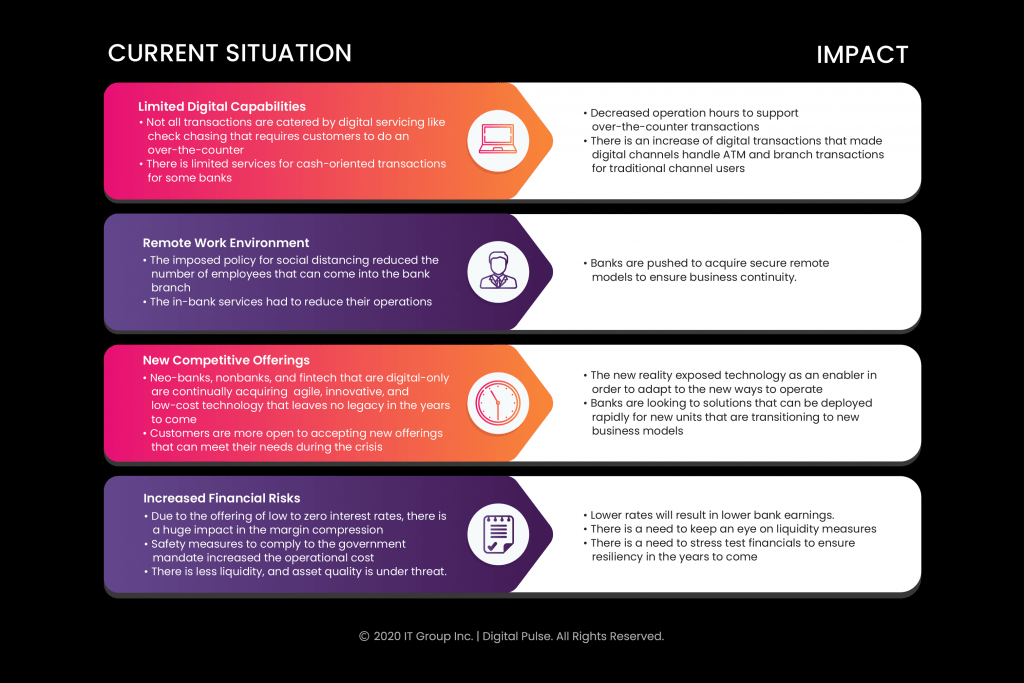

Industry Impact of COVID-19

COVID-19 has created a huge impact on a global scale that led to an unprecedented worldwide economic disruption.

The banking industry has started its digital transformation journey long before COVID-19 took place. When the crisis took a hit on a global scale, the DX investment of the banking industry suddenly had a positive effect as they are the ones who are thriving in the midst of the disruption. As everyone is mandated to work remotely, processes, both internal and external, must shift to digital. Digital banking has never been on high demand as the government is pushing for cashless transactions. The pandemic is a great testament that the banking industry must continually accelerate its digital efforts more and more.

Though the banking industry had a headstart in their digital investments, there is a need to continually invest on technologies that can accelerate their operations. The impact of COVID-19 includes all industries, including the banking industry. It’s time to rethink and accelerate digital investments. The bank’s financial performance is greatly affected by the low-interest rates given to customers which will result in a decline in their profitability.

ITG to Help Enable

- Reduced hours and operational bank branches and employees due to adhere to the social distancing measures made over-the-counter transactions more difficult

- Not all banking services are available on digital channels, especially essential transactions (such as a signature card for account opening) and still requires in-person banking

- Non-bank customers transactions such as check cashing still require support

- Heavy promotion of electronic and card payments which gives a high impact on people who are unbanked, underbanked and are heavy on cash-based transactions

- Banks are relying heavily on the skeleton and flexible workforce mix in order to continually operate while controlling costs due to operations shutdown and disruptions in demand

- There is still a need to acquire highly skilled workers with valued expertise

- Visibility of the entire workforce, including service providers, is needed

- The remote workforce must be equipped with access to the right tools, content, and training to ensure productivity

- Banks are pushed to reposition and recalibrate for the future due to the changes in customer behavior

- There is a need to implement a series of plans to mitigate the surging challenges coming out from the fluid market situation

- Disruption to the physical bank operations triggered digital adaptation which pushed the shift of to acquiring contactless banking as a new business model

- Significant pressure to banks because of their net interest margin and profitability will be notable dues to the interest rate cuts and other adjustments

- Operational costs are significantly higher than before due to the preventive measures that are mandated wherein there is a need for real-time visibility of purchasing patterns

- The current situation pushes the banks to reduce cost in longer periods of time to ensure improvement in the bottom-line profits to manage to spend

- To ensure resilience in any other disruptions to come, banks should apply stress testing and analyze scenarios using efficient financial metrics.

- Because of the changing behavior of customers in their loaning needs, banks must secure liquidity management

- There is a need to implement modified term loans to eliminate significant challenges that may arise,

- Reduced hours and operational bank branches and employees due to adhere to the social distancing measures made over-the-counter transactions more difficult

- Not all banking services are available on digital channels, especially essential transactions (such as a signature card for account opening) and still requires in-person banking

- Non-bank customers transactions such as check cashing still require support

- Heavy promotion of electronic and card payments which gives a high impact on people who are unbanked, underbanked and are heavy on cash-based transactions

- Banks are relying heavily on the skeleton and flexible workforce mix in order to continually operate while controlling costs due to operations shutdown and disruptions in demand

- There is still a need to acquire highly skilled workers with valued expertise

- Visibility of the entire workforce, including service providers, is needed

- The remote workforce must be equipped with access to the right tools, content, and training to ensure productivity

- Banks are pushed to reposition and recalibrate for the future due to the changes in customer behavior

- There is a need to implement a series of plans to mitigate the surging challenges coming out from the fluid market situation

- Disruption to the physical bank operations triggered digital adaptation which pushed the shift of to acquiring contactless banking as a new business model

- Significant pressure to banks because of their net interest margin and profitability will be notable dues to the interest rate cuts and other adjustments

- Operational costs are significantly higher than before due to the preventive measures that are mandated wherein there is a need for real-time visibility of purchasing patterns

- The current situation pushes the banks to reduce cost in longer periods of time to ensure improvement in the bottom-line profits to manage to spend

- To ensure resilience in any other disruptions to come, banks should apply stress testing and analyze scenarios using efficient financial metrics.

- Because of the changing behavior of customers in their loaning needs, banks must secure liquidity management

- There is a need to implement modified term loans to eliminate significant challenges that may arise,